Use cases

Payments features

Open a business account with Fondy Wallets

UK business bank account for Spanish residents

Tired of waiting days for funds to clear? Frustrated by rigid banking systems that don’t suit your global business needs? Wave farewell to those headaches and open a UK business bank account tailored for residents of Spain & the EU. This isn’t just another bank account — it’s a game-changing financial tool crafted specifically for freelancers, marketplace sellers, platform collaborators, and online business owners. Whether you’re a non-resident living outside the UK, Fondy empowers you with fast, seamless money movement and total control over your transactions.

Lightning-fast access to your money

With instant settlements, your cash flow gets a serious boost. No more delays holding you back — payments hit your account the moment they’re made, ready for you to use.

Effortless payouts made simple

Send money to suppliers, partners, or contractors with just a few clicks, keeping your operations running smoothly and your relationships strong.

Complete financial clarity

Dive into performance analytics and get a crystal-clear view of your account activity — everything you need to make smart decisions, all in one place.

Get up and running in no time

Today’s businesses don’t have time to waste on lengthy setups or complicated paperwork. That’s why Fondy offers the best business bank account for non-UK residents, designed for speed and simplicity. Unlike traditional UK banks that demand residency or endless documentation, Fondy lets you open a UK business bank account online as a Spanish resident in mere minutes. Here’s how it works:

Open a UK business account

for Spanish residents with a few quick steps

Start accepting payments

from platforms, marketplaces, or clients worldwide

Take charge of your finances

send payouts, track funds, and grow your business

Ready to ditch the slow, outdated banking systems?

With Fondy, you’re not just opening an account — you’re unlocking a smarter way to manage money as a non-UK resident.

Master your finances with instant settlements

Let’s talk about what sets Fondy apart: instant settlements. Picture this — you’ve just closed a deal with a client in London, sold a batch of products on a marketplace, or received a payout from a platform partner. With a traditional UK company bank account, you might wait days for that money to become usable. Not with Fondy. Those funds land in your account instantly, ready to reinvest, pay suppliers, or cover expenses. For non-UK residents seeking a UK online business bank account, this feature is a game-changer. Here’s what it unlocks:

- Diversify your income by tapping into new markets without cash flow delays

- Focus on scaling your business instead of chasing payments

- Enjoy peace of mind with immediate access to your earnings, balancing work and life effortlessly

Take a freelancer in Spain, for example. They complete a project for a UK client via a platform. With Fondy, the payment arrives instantly, letting them pay a collaborator in the UK the same day. Compare that to a traditional bank, where they’d be twiddling their thumbs for up to a week. That’s the Fondy difference — speed and control, tailored for Spanish residents.

Simplify payouts and strengthen partnerships

Running a business often means juggling payments to suppliers, partners, or team members. Fondy’s UK business account for Spanish residents makes it painless. Whether you’re settling invoices with a supplier in Manchester or sending funds to a contractor in the EU, payouts are fast, reliable, and hassle-free. Here’s how it benefits you:

- Manage and dispatch payments to partners and suppliers from one intuitive dashboard

- Build trust with timely, dependable transactions that keep your network happy

- Handle everything in GBP, no matter where you or your partners are based

Picture a marketplace seller in Spain. They use Fondy to instantly pay their UK-based logistics provider after a big sales day. No currency headaches, no delays — just smooth operations. For non-UK residents, this level of convenience is unmatched by traditional banks, which often exclude Spanish residents or impose sluggish processing times.

Open your business account now, regardless of your location – Spanish residents accepted!

Why should UK residency dictate your access to a top-tier business account? With Fondy, it doesn’t. Open a business bank account in the UK as a non-resident, regardless of your location, and enjoy cash flow that flows as freely as your ideas. Whether you’re in Spain building an e-commerce empire or in any other country managing a freelance network, Fondy brings UK banking to you — faster, smarter, and simpler than ever.

After opening a business account, your options expand even further

Meet digital wallets for the global entrepreneurs

Traditional UK banks cater to local businesses with rigid rules — residency requirements, slow settlements, and limited flexibility. Fondy flips the script, offering a UK company bank account for Spanish residents that’s built for the borderless economy. You get all the perks of a UK account: GBP transactions, credibility, and access without the red tape.

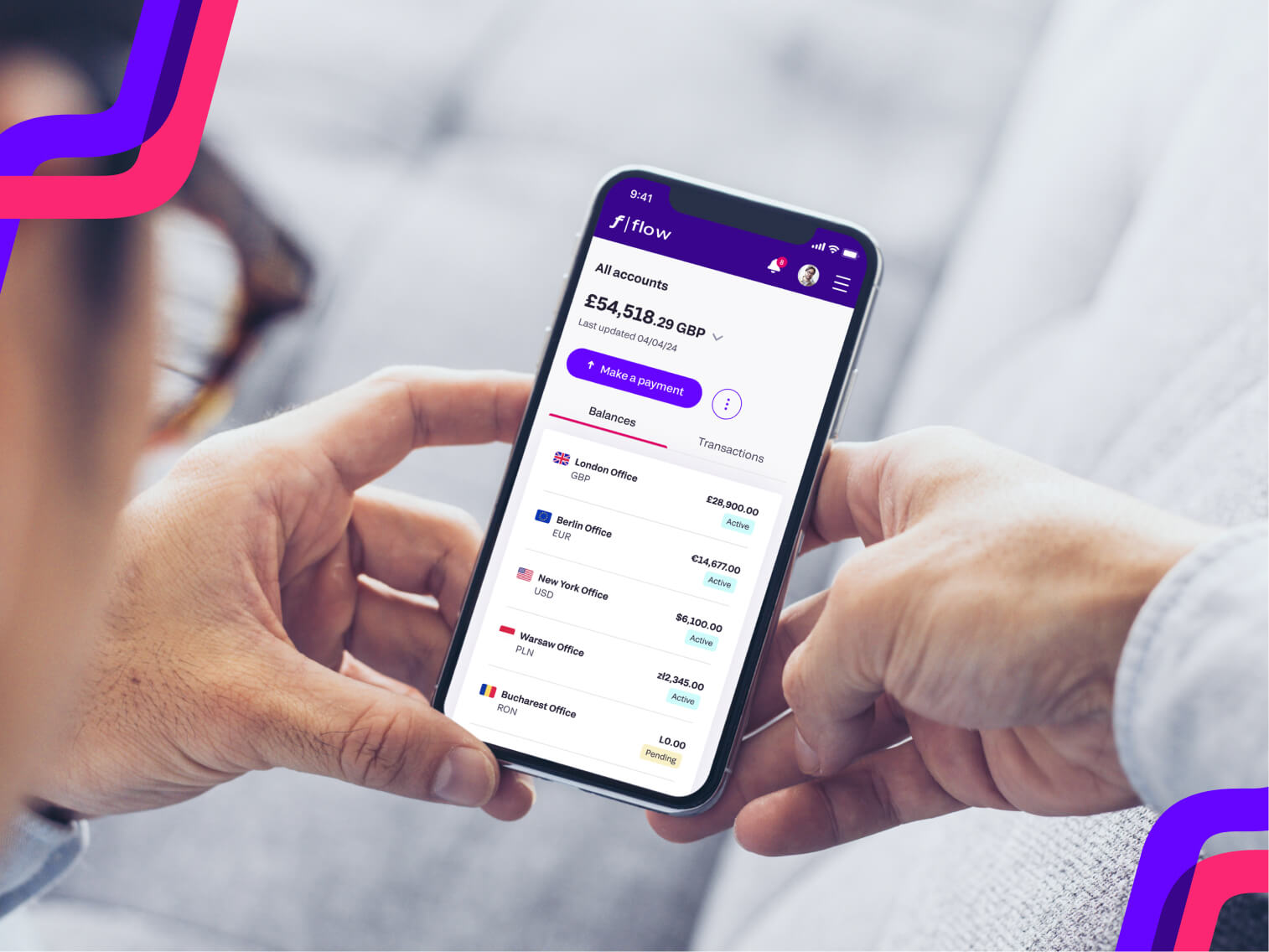

Simplify global trading with virtual accounts

Boost your business with tailored solutions with tailored solutions

Running a company, whether small or sprawling, means navigating a web of international payments. Fondy’s UK company bank account for Spanish residents offers a British edge with virtual accounts that transform how traders operate. Forget the complexity of managing foreign currencies or juggling multiple corporate accounts. With Fondy, your company gets a single, sterling-based hub, complete with virtual accounts that streamline cross-border transactions. Each virtual account comes with its own unique number, letting you assign one to a supplier, another to a client, and a third to operational costs — all under one roof.

This setup is perfect for small companies, international traders, or growing firms needing current, flexible tools to handle cash flow. Imagine a small e-commerce company in Spain using a virtual account number for a UK buyer, another for a supplier in the EU, and tracking it all effortlessly. Unlike traditional banks, Fondy’s virtual accounts don’t demand a physical UK presence, making them ideal for international companies seeking a foothold in British markets. Need to issue a client-specific number for recurring payments? Done. Want a current snapshot of your funds across all accounts? Fondy delivers. This isn’t just banking — it’s a smarter way for small companies and solo traders to manage international growth with virtual precision, keeping your company agile and your finances clear.

Unlock even more with your account

Meet Fondy’s digital wallets

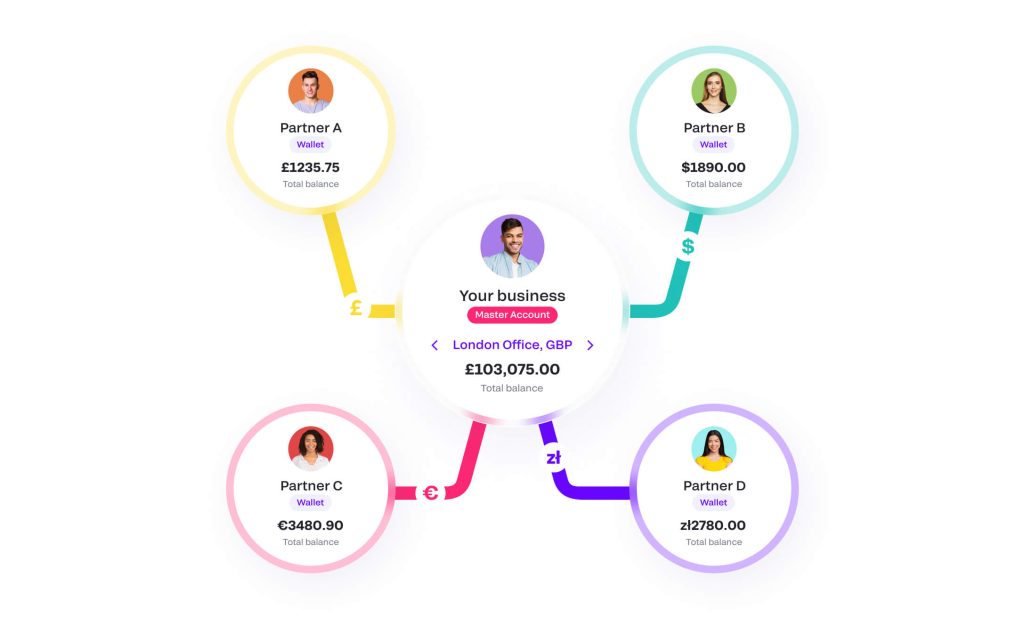

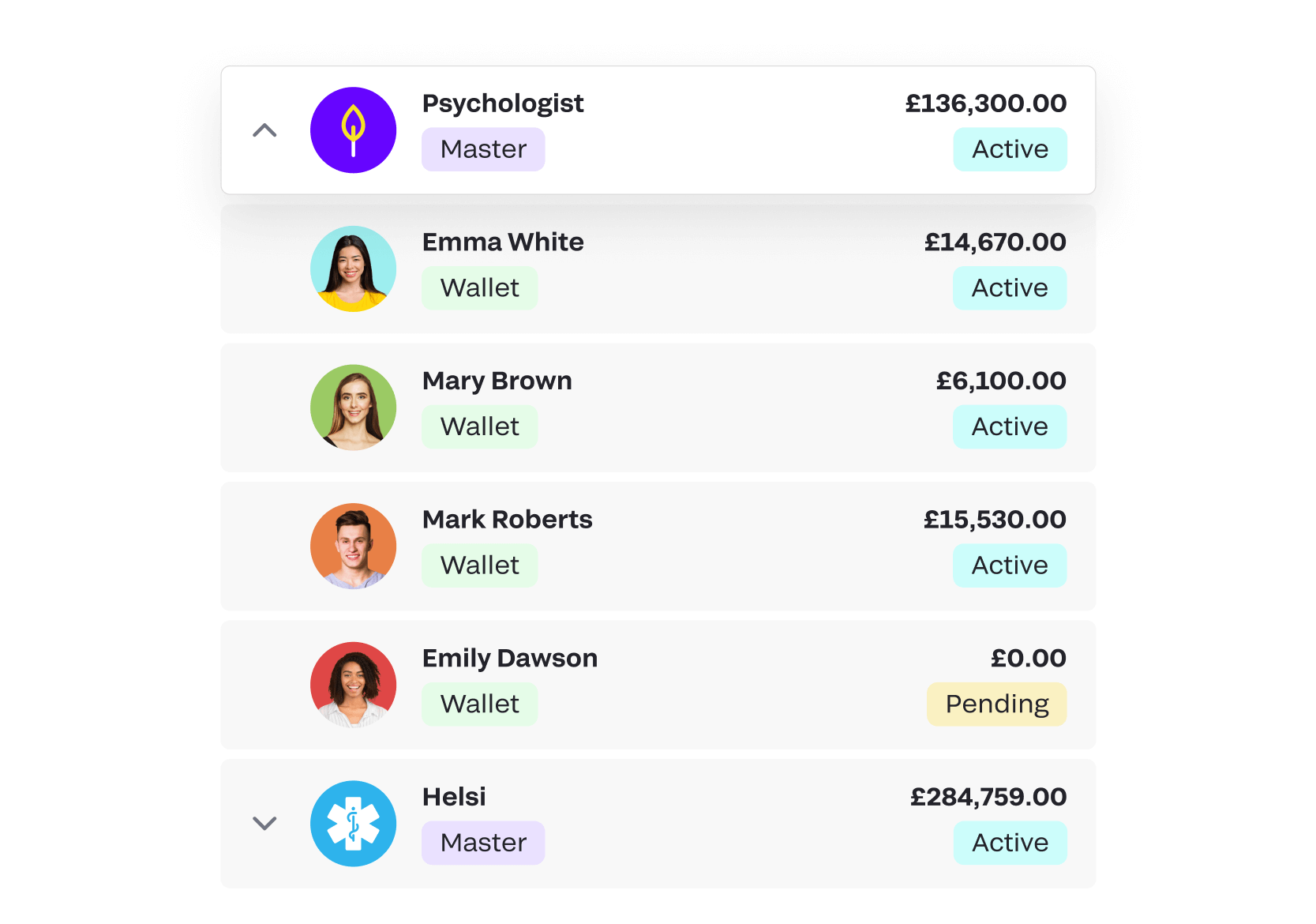

Once you’ve opened your UK business bank account for Spanish residents, the possibilities expand with Master Accounts and digital wallets. These tools make partnerships smoother, smarter, and more transparent. Whether you’re a platform owner, a marketplace operator, or a business with B2B clients like contractors and sellers, this feature lets you and your network manage money effortlessly. A Master Account acts as your central hub, while linked wallets give partners their own space to handle funds — all under your oversight.

Speed that traditional banks can’t match

While banks might leave your funds in limbo for days, Fondy’s instant settlements mean your money is yours to use right away. It’s a lifeline for non-UK residents who can’t afford to wait.

A solution for every business type

From solo freelancers to sprawling marketplaces, Fondy adapts to your needs. No matter your scale, you’ll find tools to streamline finances and fuel growth — something rigid bank accounts rarely offer non-residents.

Full visibility, total control

Fondy puts you in the driver’s seat. Monitor funds, tweak settings, and track every transaction across your wallets with ease. For Spanish residents, this means running a UK business account online with the precision and clarity you need to succeed globally.

Quick wallet setup

Create a new account and add a wallet to your Master Account in minutes using our API — perfect for fast-moving businesses.

Custom wallets for clarity

Rename wallets to reflect their purpose — like “Supplier Payouts” or “Freelancer Fees” making organisation a breeze.

Transparent payment tracking

See every wallet linked to your Master Account at a glance, with detailed breakdowns of balances and transactions.

Powerful financial tools

Download consolidated statements for your Master and wallet accounts, giving you a clear snapshot to plan and optimise your finances.

Real-world benefits for you and your partners

Explore the potential of our Master Accounts and Wallets to elevate your business

Smarter account management

Set up multiple Master Accounts, each with its own tailored wallets, to handle diverse financial needs. A marketplace in Spain, for instance, could create one Master Account for seller payouts and another for operational costs — all in GBP. This setup ensures funds are distributed efficiently, reconciliation is a breeze, and oversight is airtight. It’s the ideal business account in the UK for Spanish residents who want control without complexity.

Wallets that work together

Each wallet operates independently but ties back to a single Master IBAN. Unique references make them easy to spot and manage, even as your network grows.

Balance oversight made simple

Check your Master Account’s unified balance and see the combined total of all wallets instantly. A platform owner in Spain could use this to decide when to reinvest or distribute profits — all with a comprehensive view of their UK-based finances.

Build stronger partnerships

Fondy Wallets offer a wealth of advantages for partners, boosting operational efficiency and optimizing money management. Among the primary benefits are:

Effortless transaction monitoring

Wallets let partners track payments, manage funds, and access reports in real time. A contractor in the UK, for example, could see a payout arrive, download a statement, and plan their next move — all within their wallet.

Uninterrupted cash flows

Partners enjoy dedicated wallets that keep funds accessible and transactions swift, cutting delays and boosting efficiency — crucial for non-UK residents collaborating globally.

Custom solutions for every partner

Tailor wallets to fit specific needs, whether it’s handling platform fees, processing client payments, or analysing cash flow. It’s a level of flexibility that keeps partners loyal and operations thriving.

Take the next step

Ready to transform your finances? Open a business account in the UK for Spanish residents with Fondy and unlock the full potential of Master Accounts and wallets. From simplifying money management to forging lasting partnerships, Fondy is your gateway to success, whether you’re a marketplace, platform, or solo entrepreneur.

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.