Use cases

Payments features

Online payments

Accept online payments for business in Germany with Fondy

With our solutions, you can easily and securely accept online payments. Our payment tools will help grow your online store or other business and increase revenue. Regardless of the size of your company, Fondy offers comprehensive support that allows you to focus on growth and customer service.

Our solutions ensure fast payment processing, leading to customer satisfaction and financial stability for your company.

No matter the type of your business, we have options for accepting online payments

Our systems work well in both small businesses and large corporations. Whether it’s a mobile app, marketplace, eCommerce or one-page site, Instagram store – the right tool for accepting online payments is available for everyone. This allows you to focus on growing your business, leaving payment matters in our hands.

Applications

Accept payments on the website

Our solutions work equally well on both simple and complex websites. With over 30 integrations with popular CMS, plugins, and payment links, you can set up online payments on your site without needing developers.

Adding a payment button requires minimal front-end experience. Online payment integration is quick and easy, saving you time and resources.

Our detailed API and SDK documentation is our pride and support for your development team, ensuring easy and effective payment processing.

Accept payments in the mobile app

Mobile app users get a native payment page, and businesses get all the necessary tools for accepting online payments. Buyers can make not only one-time but also recurring and regular payments through your mobile app on iOS or Android.

The online payment setup process will be quick thanks to detailed documentation for Android, iOS, and React Native SDK.

Fondy’s mobile SDKs not only enable you to embed tools for accepting online payments but also free you from certification according to the PCI DSS standard. This ensures your app meets all security requirements, allowing you to focus on growing your business.

Accept payments without a website

With Fondy, you can conveniently and securely accept online payments even if you don’t have a website. Payment links for individual products will help small businesses accept payments on social media.

Freelancers, creators of original products, trainers, or healthcare professionals can organize payments through single invoices.

With MO/TO payments, hotels and similar businesses can guarantee the required amount is charged or pre-authorized on the customer’s card, ensuring financial stability and transaction security.

Take online payments with Fondy

Diverse

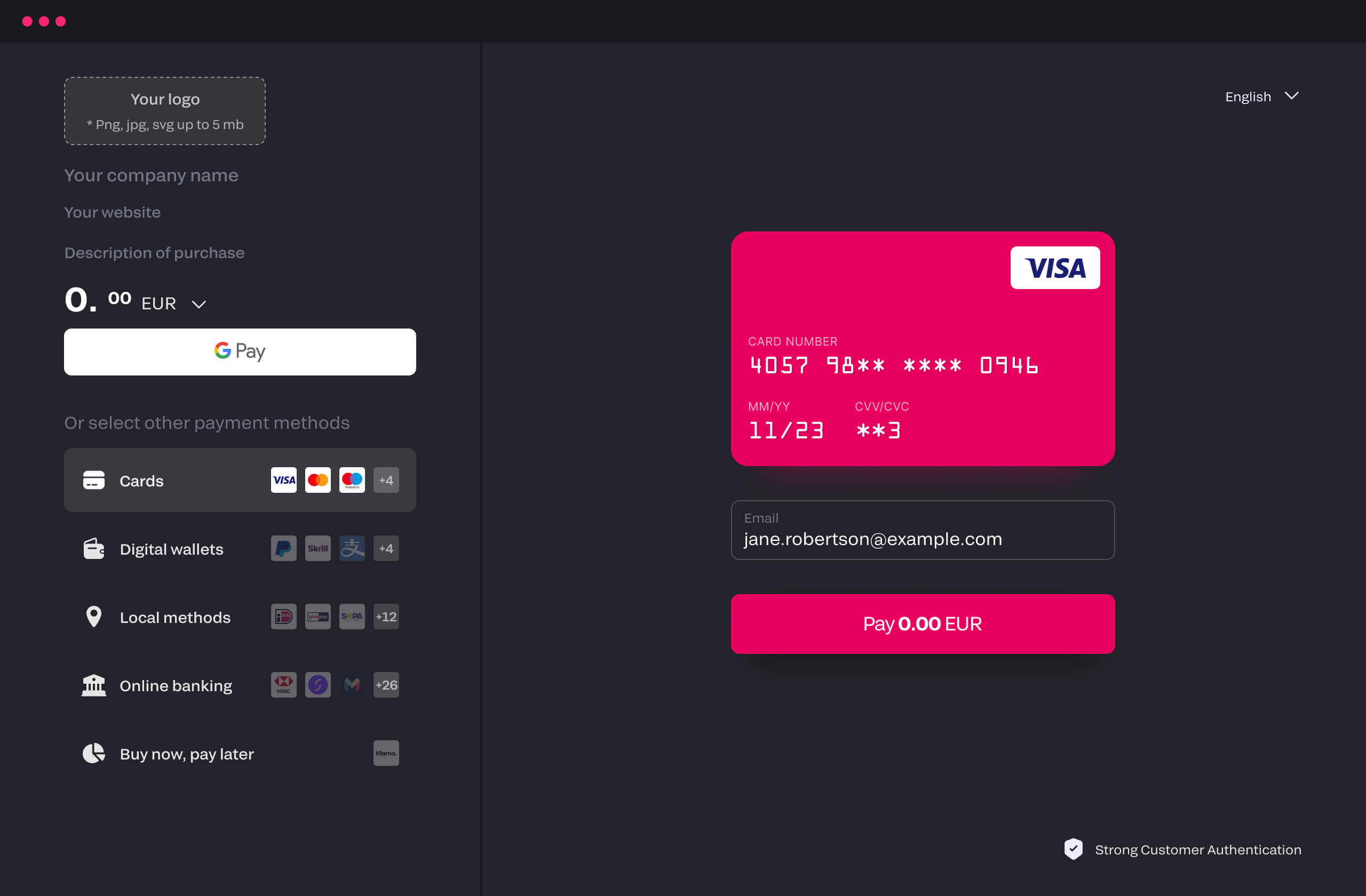

Various use cases: embedded on the website, redirected to the Fondy payment page, in a mobile app. You can customize the online payment integration method to suit your business’s specifics, ensuring flexibility and convenience for you and your customers.

Efficient

Conversion up to 98%: high payment processing speed, optimized for the purchase region. Our systems guarantee fast and seamless online payments, leading to greater customer satisfaction and higher revenue for your business.

Convenient for your Customer

Consistent user experience: responsive on any device, native payment form in the mobile app. Your customers can conveniently make online payments, whether using a computer, tablet, or smartphone.

Even more convenient for you

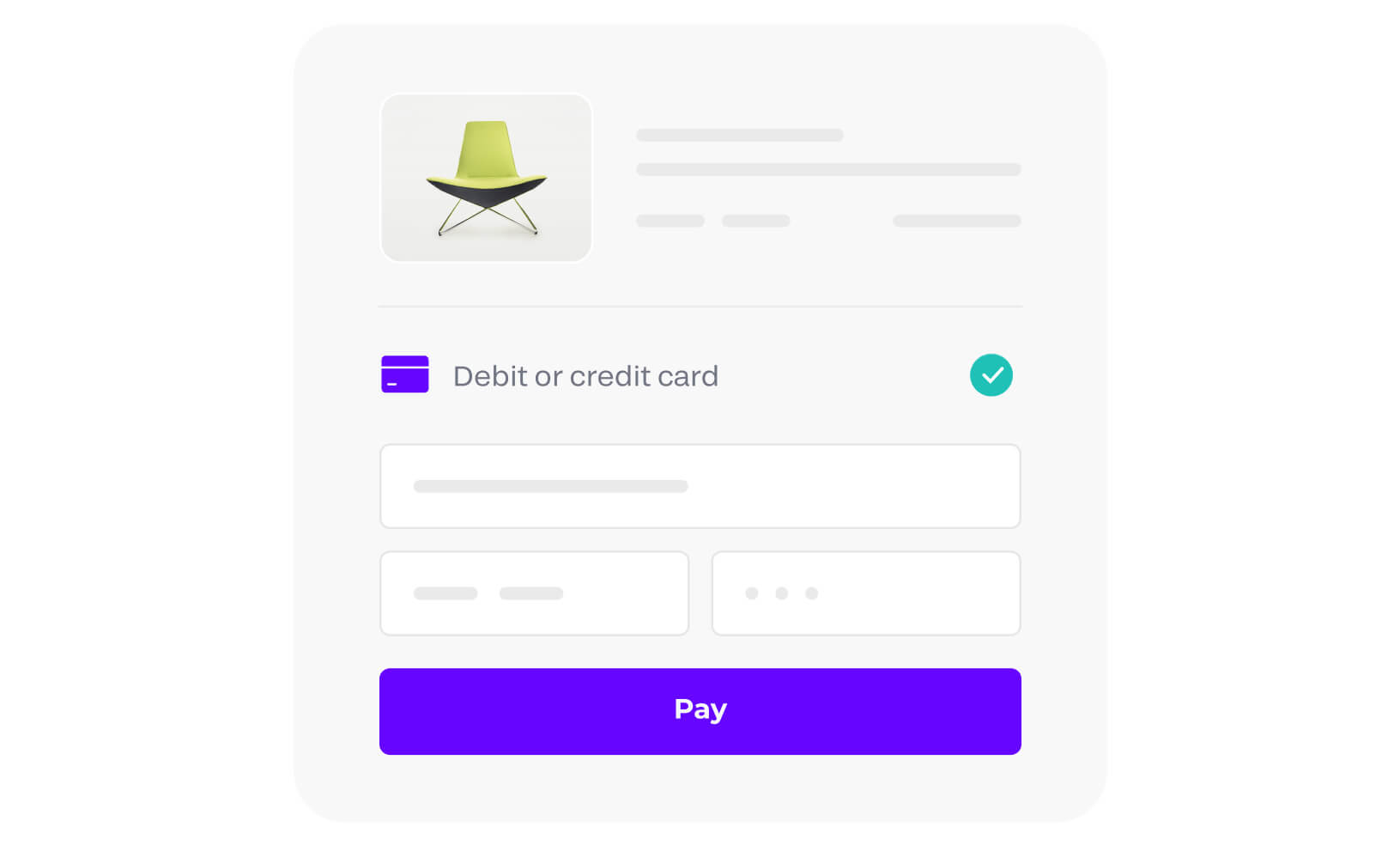

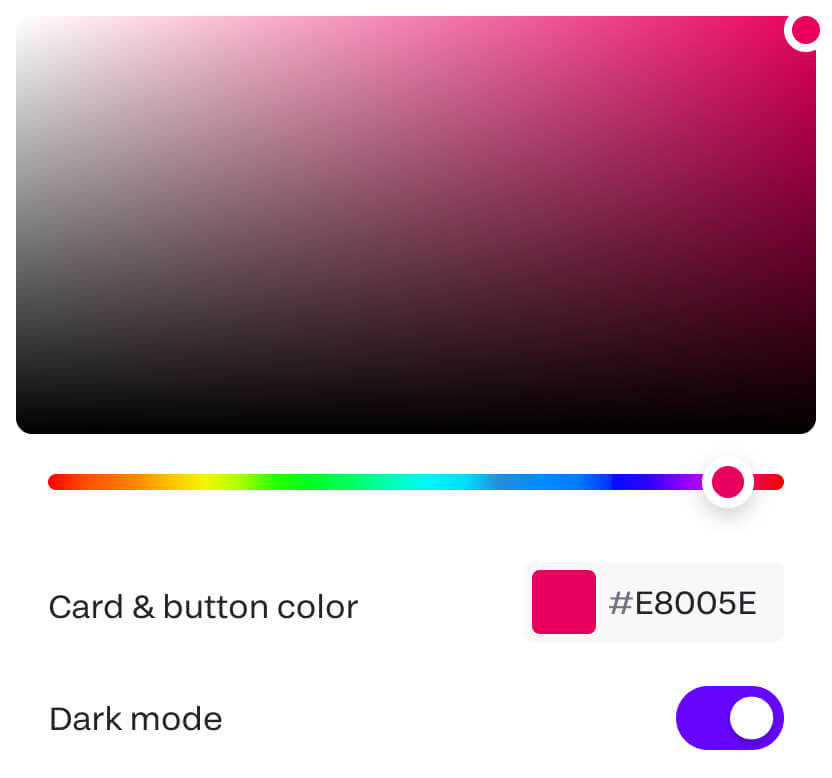

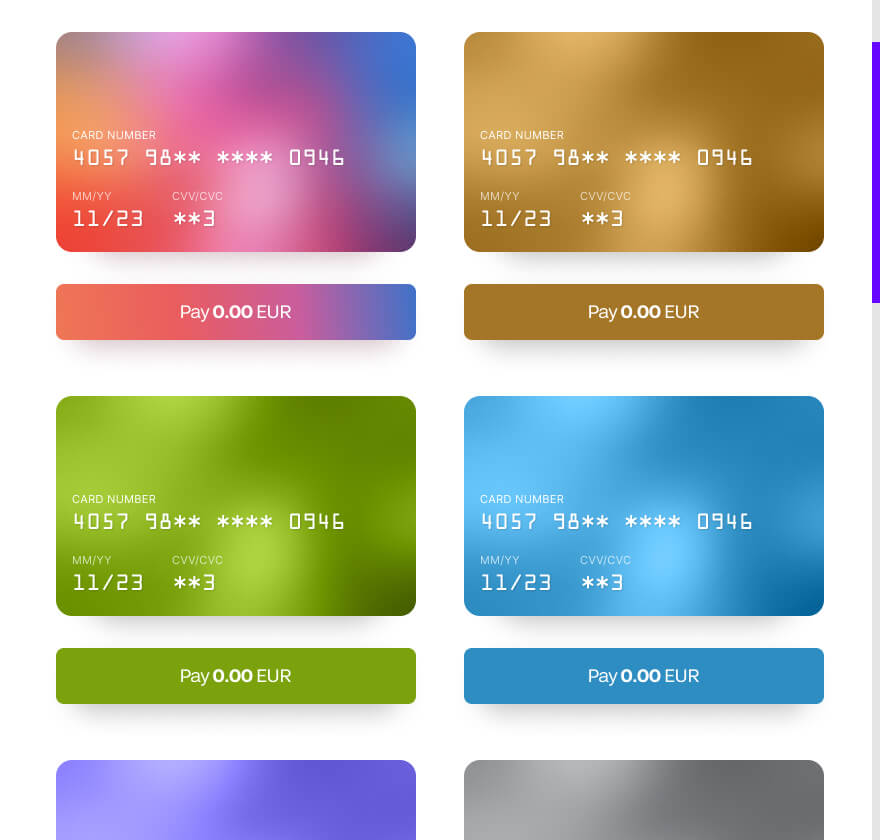

Flexible settings: simple page appearance configurator, color themes, field and button customization. This allows you to quickly and easily customize the payment page to match your website’s look, enabling seamless online payment integration without needing additional resources.

Fondy online payment page tailored to your branding

Loads in a second, processes payments in milliseconds. Convenient for the user, efficient for you. Our solution ensures speed and reliability, translating to higher customer satisfaction and operational efficiency for your business. Various themes, the ability to add a logo, and 200 color templates – the payment page will blend seamlessly into your website or app design. This ensures that online payment integration is not only functional but also aesthetically aligned with your brand, enhancing your brand’s consistency and professionalism.

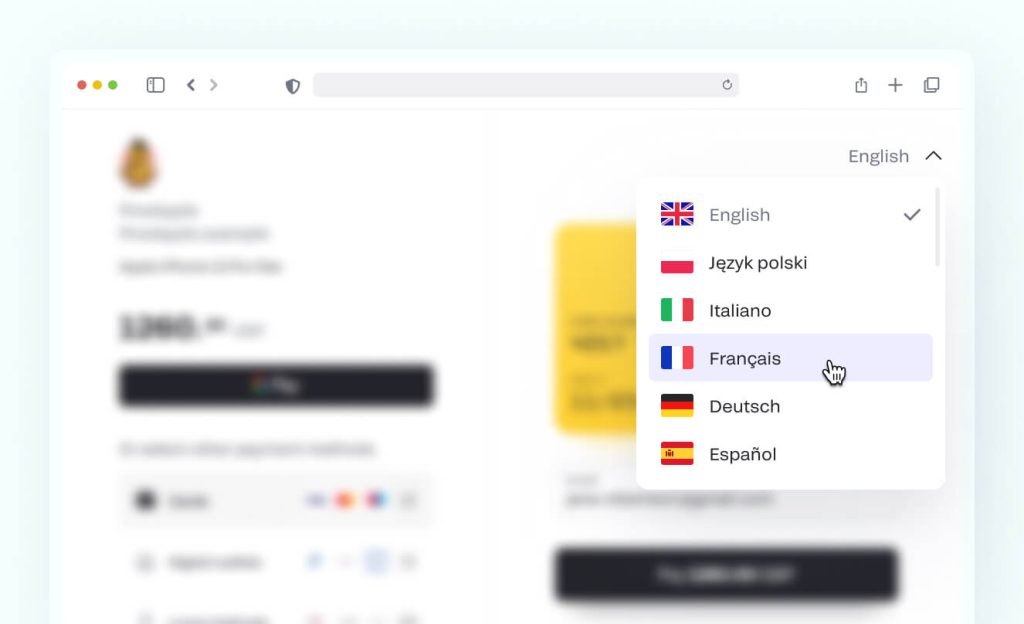

Multilingual

The page will adapt to the user and automatically switch to one of the 15 available languages. This allows your customers to use online payments in the language they are most comfortable with, increasing their convenience and satisfaction.

Multicurrency

With support for all convertible currencies worldwide, your business is not limited to accepting online payments only in Germany. You can freely expand your operations to international markets, offering customers the option to pay in their local currencies.

Take online payments securely

Encryption and 3D-Secure activation protect your customers’ credit card and e-wallet data. Our solutions provide the highest level of security, protecting both you and your customers from fraud and unauthorized transactions.

Fondy — a ready-made and effective solution for your business

Be closer to your customers. By connecting to Fondy’s online payment gateway, you receive the following capabilities:

Accept payments from all over the world

From 200 countries, in 151 currencies, with fund transfers to bank accounts in PLN or EUR. This allows your business to globally accept online payments without worrying about currency limitations.

Offer key payment methods

Including Visa, Mastercard credit cards, and electronic wallets like Apple Pay, Google Pay, BLIK. We enable you to accept online payments using the most popular methods, increasing convenience and accessibility for your customers.

Collect recurring payments

From the customer’s account using an external or embedded payment calendar. Automating recurring payments allows for efficient management of subscriptions and regular financial commitments.

Block payment amounts

And refund it to the customer from the user panel without fees. Our tools allow temporary fund blocking, increasing transaction security and allowing flexible refund management.

Split payments

As a commission on payment or by splitting the payment between partners. This solution is ideal for business models based on partnerships, enabling precise and automated settlements.

Bring back customers

Thanks to automatic reminders of abandoned carts. Our tracking systems help increase conversion by reminding customers of unfinished purchases and encouraging them to return to the site.

Refund order amounts

From the user panel with a few clicks if the customer decides to return the goods. Fast and easy return management enhances customer service and increases their satisfaction.

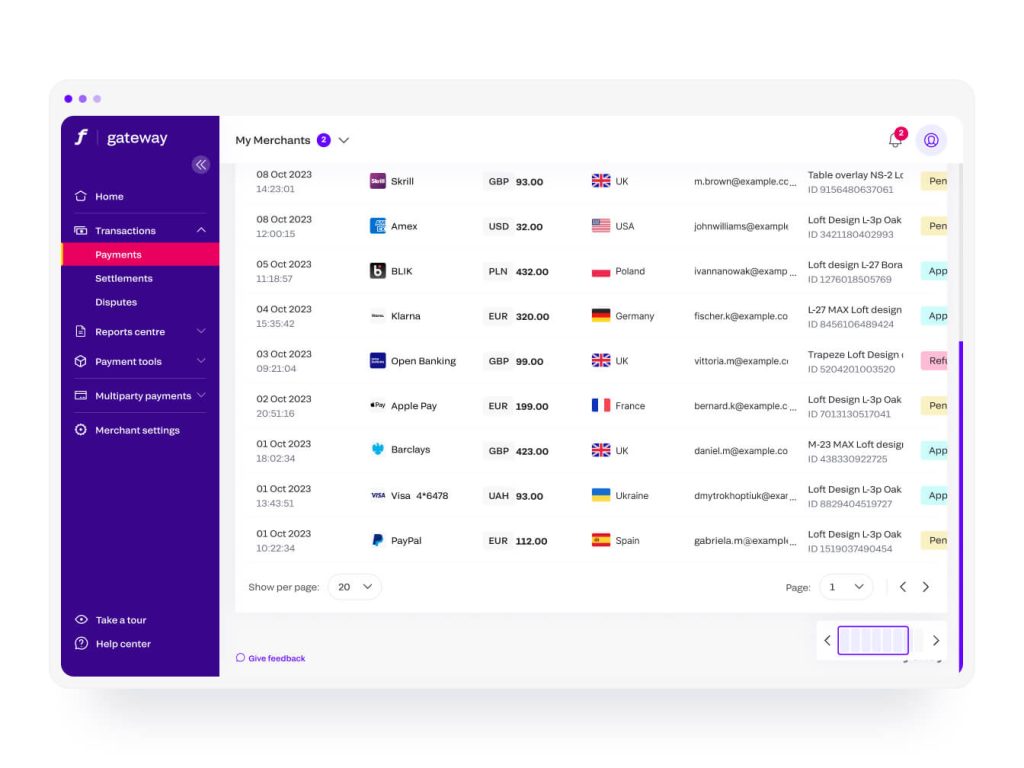

Track every transaction

By tracking all payments in an advanced seller’s analytics panel. This allows for precise monitoring and analysis of transactions, supporting financial management and strategic planning.

Protect your business from fraud

With the Fondy.Antifraud system, which uses 300 rules to detect fraudulent activities online. Our advanced security tools provide protection against fraudulent transactions, safeguarding both you and your customers.

Fondy online payment dashboard – understand and empower your business even more

We have combined all the tools for working with the service in one place – the Fondy online dashboard. This gives you full control over accepting online payments and managing your finances.

Grow your store or other business and discover consumer trends with comprehensive analytics and tailored reports. Our dashboard allows you to track online payments in real time, enabling a better understanding of customer behavior and making informed business decisions.

Connect online payments now

Create an account in the system

Choose one of 4 registration methods to quickly start accepting money from your customers.

Activate the seller account

The process consists of 5 steps in the online panel. It’s simple and intuitive, so you’ll easily go through all the stages.

Choose the right solution

There are many, but you’ll quickly find yours. Fondy offers a variety of online payment tools that will perfectly fit your needs.

Connect the payment tool

We’ll help you at every stage, providing technical support and step-by-step guides. Online payment integration has never been so easy.

Done

You accept online payments from Germany, Europe and worldwide with Fondy. Now you can enjoy seamless and secure electronic payment processing for your business.

Start accepting online payments today

Use a variety of payment methods (BLIK, etc.) to increase customer satisfaction and improve sales. With Fondy, your customers can conveniently make online payments, leading to better financial results for your business.

Open an Account

Request a demo of our online payment gateway portal. Start accepting electronic payments seamlessly, allowing you to focus on growing your business.

Request a Demo

Contact us to see how Fondy can support your business. Our demo will show you how easy it is to integrate online payments and enhance your business’s operational efficiency.

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.