Use cases

Payments features

Grow sales with the best payment gateway in Czech Republic

Fondy is an international payment gateway service for business from Czech Republic and EU countries. We assist eCommerce, SaaS, marketplaces, platforms, HoReCa, EdTech, and others to grow both locally and globally with a single integration. Our financial technologies enable you to set up online payment gateway acceptance according to your needs and increase sales. For your customers, we provide convenience in payments, enhancing their loyalty.

We know what modern entrepreneurs need, and we provide it

Start accepting payments from customers today

By connecting to Fondy service in the morning, you can start receiving your first payments from your customers by the evening. Our payment gateway integration makes it seamless.

Sell everywhere your customers are

With us, you are not limited in sales channels – accept online payments on your website, social media, mobile apps, and even offline.

Grow your business in global markets

Integration with system Fondy allows you to operate in Czech Republic, the United Kingdom, and the EU, while accepting payments from all over the world. We are recognized as one of the best payment gateways in Europe.

Use thoughtful solutions for any task

We have a complete set of tools necessary for managing incoming and outgoing payments in your business, including credit card payment gateway options.

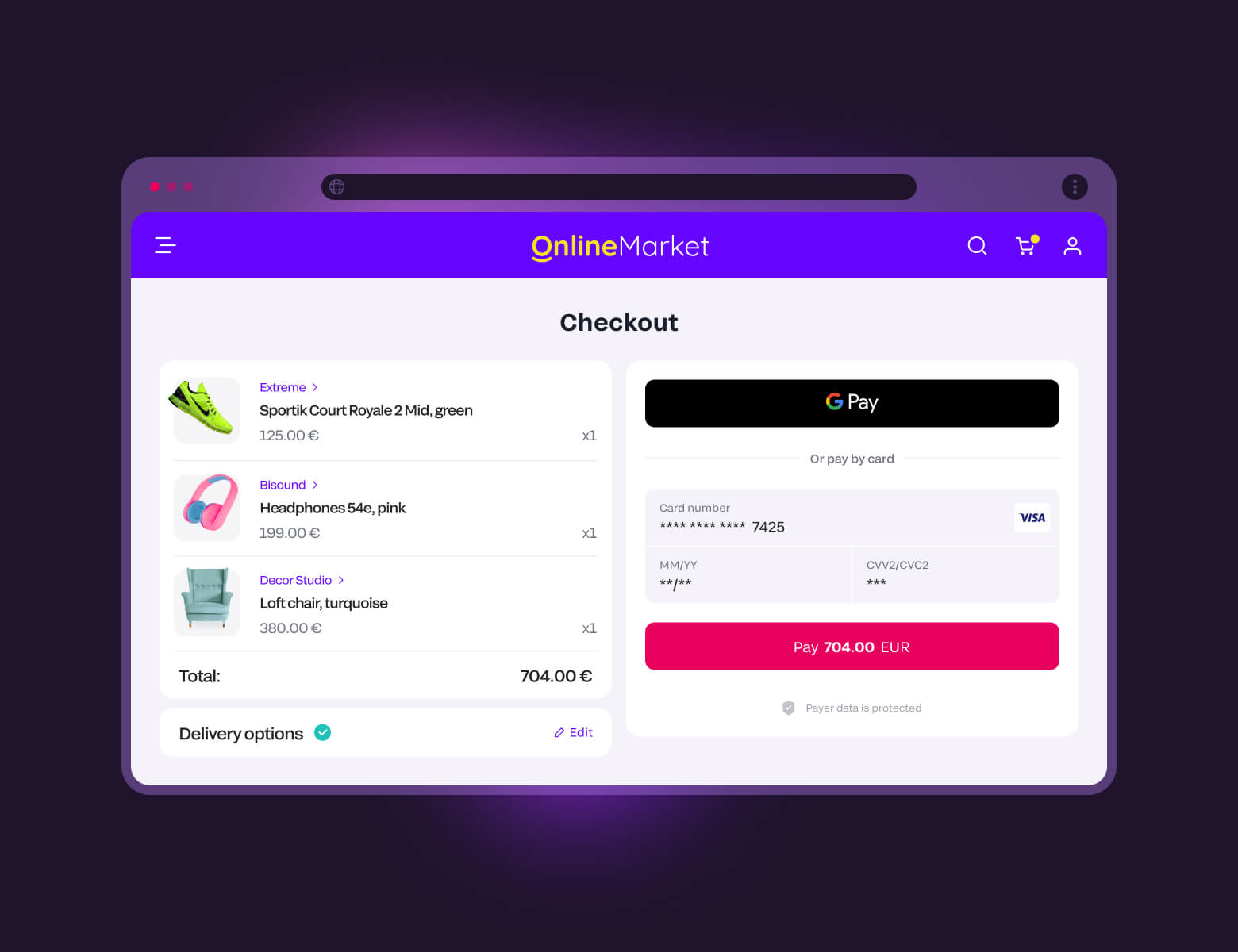

Customised payment methods

Experience the ease of local payments with processing Fondy. We offer over 300 payment methods, tailored to your customers’ location. Using advanced geolocation, we ensure that your customers always see the most relevant and familiar payment options (like BLIK, iDeal etc.)

Key Benefits:

- Tailored Payment Options: Automatically display local payment choices including regional cards, internet banking, and popular eWallets like Apple Pay and Google Pay.

- Global Compatibility: Support for international debit and credit cards ensures seamless transactions worldwide.

- Personalized Experience: Returning customers are instantly shown their previously preferred payment methods, making repeat purchases faster and more convenient.

Simplify your payment process and boost your sales with Fondy company.

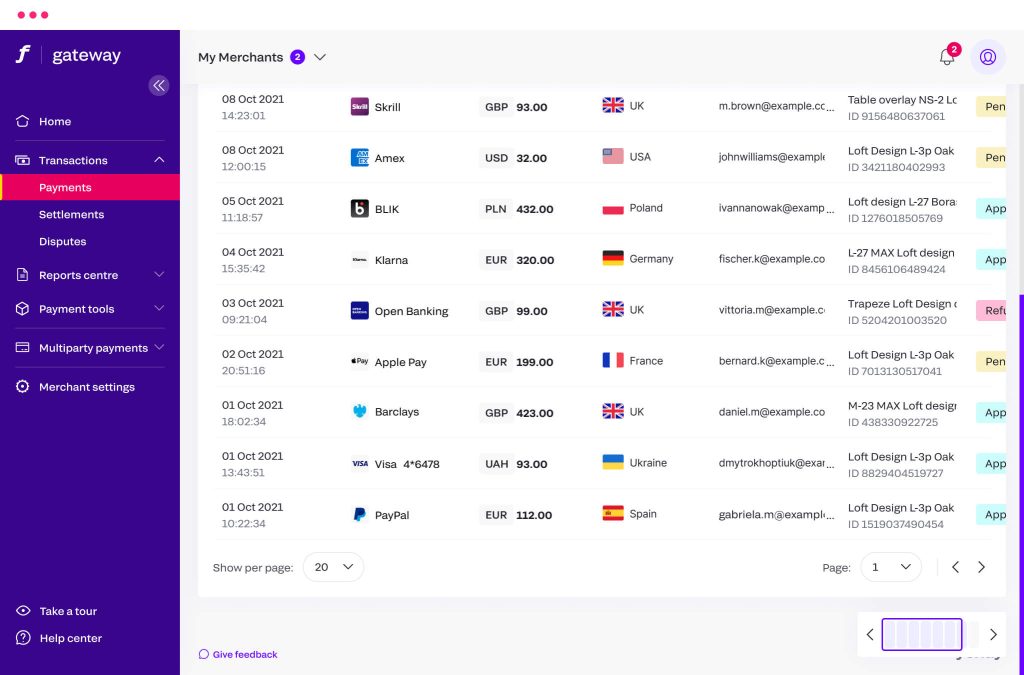

Solutions for better business

Create a seamless customer experience and accept, settle, and track payments all in one place with our advanced payment gateway solutions. Our platform allows you to integrate multiple payment methods into a single, user-friendly interface, ensuring that your customers can easily make payments using their preferred methods. Whether you are processing credit card transactions, Blik, Google Pay, Apple Pay or QR payments, our system handles everything smoothly and efficiently.

Additionally, you can manage all aspects of payment processing, including billing and invoicing, from one central location. This comprehensive approach not only simplifies the payment process for your customers but also provides you with detailed tracking and analytics to monitor and optimize your business operations. With our robust and secure payment gateway, you can focus on growing your business while we take care of the rest.

The best payment gateway for accepting payments

Anywhere your business interacts with customers

Give your customers the convenience of paying wherever they prefer. With us, you can be present both online and offline, selling on your website and beyond. Our universal payment gateway ensures seamless integration across all platforms.

For simple landing pages on CMS and complex websites

Quick start without development or tailored to your specific needs.

By using a payment button or one of the 23+ ready-made plugins for popular CMS and website builders, you can enable online payments on your site in 15 minutes without writing a single line of code. With the SDK library and API, you can build your own logic for systematic online payment gateway acceptance.

For social media and messengers

Instant creation and quick interaction with payers.

By generating an online invoice or payment link in just a few clicks, you can sell online, accepting payments via social media, messengers, or email. It only takes a few minutes, and the money will be in your account. No website is necessary for this.

For mobile apps on different platforms

Seamless payment process for a better user experience.

By using the SDK for iOS & Android platforms, React Native, and other frameworks, along with detailed API documentation, your developers can integrate payment gateway acceptance into the mobile app more easily and quickly.

For retail points and offline payments

No websites, banks, or additional equipment needed.

By accepting offline payments using QR payments, you can permanently do away with bank terminals, cash, and the need to create a website. Then, you can grow your business beyond the internet with modern and reliable tools from provider Fondy, including our secure payment gateway solutions.

Fondy payment gateway is featured in

Manage payments from your computer, tablet, and smartphone

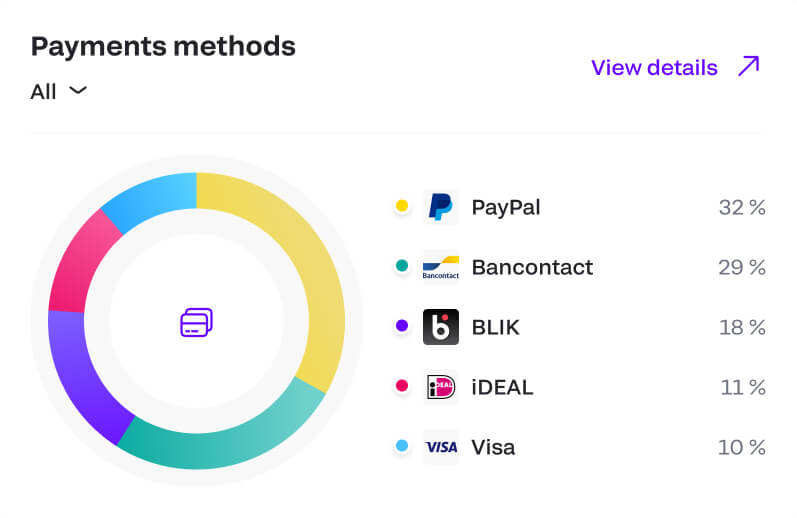

We have integrated all the necessary functionality for managing incoming and outgoing payments, as well as analytical tools, into a single interface – the Fondy merchant account.

– Analyze how customers make payments using cards, electronic wallets, and other payment methods.

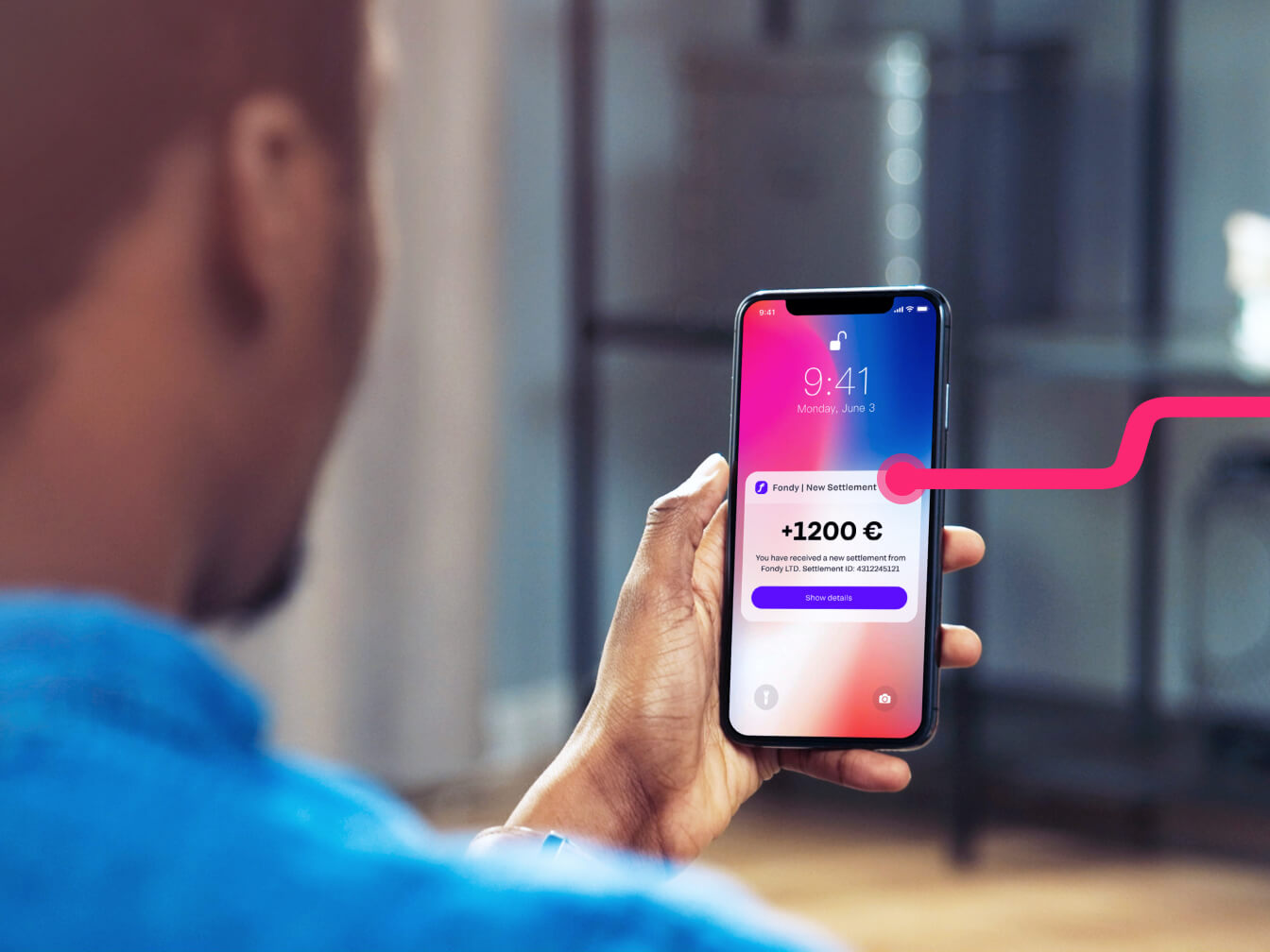

– Receive system notifications about payments in real-time.

– Generate custom reports and save them electronically in a convenient format.

– Track refunds for payments to your account.

All of this will help you make informed business decisions based on accurate data with our comprehensive payment gateway solutions.

The best solutions for every business

At system Fondy, we provide tailored payment gateway solutions designed to meet the unique needs of every business. Whether you are in eCommerce, SaaS, marketplaces, or any other industry, our best payment gateway services ensure seamless and secure payment processing. With integrations for popular CMS platforms, multi-currency support, and advanced payment features, you can easily manage and grow your business. Let us help you streamline your payment processes and enhance your customer experience with our comprehensive and reliable solutions.

Ecommerce

Sell more online and scale your business with our payment solutions for websites and online stores. Ready integrations with popular CMS, abandoned cart recovery, one-click payments, refunds to cards without fees – with these and other Fondy features for ecommerce, your business will grow every day. Our best payment gateway for ecommerce ensures smooth and secure transactions, enhancing customer satisfaction and increasing your sales.

EdTech

Start earning today with Fondy’s ready-to-use tools for a quick start in online education. Enable payment acceptance on your website or landing page in one day using our payment button or CMS plugin. Our online payment gateway ensures seamless integration and easy setup. Then, continue to accept payments with minimal effort 24/7, allowing you to run your business effortlessly and focus on providing quality education.

SaaS services

Keep your business running without interruption by entrusting us with seamless multi-currency payment acceptance. Set up a ready-made billing schedule from bank cards in your Fondy merchant account or manage recurring payments on your website or mobile app according to your needs. Our multi currency payment gateway ensures smooth transactions across different currencies, helping you manage your finances efficiently and keep your operations running smoothly.

Marketplaces

Simplify your business processes by delegating payment acceptance and management to provider Fondy. We offer comprehensive payment gateway solutions for marketplaces, including integrations with popular CMS, payment splitting, payouts to cards, recurring payments, and fee-free refunds. These and other tools will help you run a complex business more easily. Our secure payment gateway ensures that all transactions are processed smoothly and securely, giving you peace of mind and allowing you to focus on growing your marketplace.

Think globally, act locally

With Fondy’s payment gateway solutions, you can expand your business globally while catering to local market needs. Our multi currency payment gateway ensures you can accept payments from Czech customers and around the world, offering them the convenience of paying in their preferred currency.

Adaptive payment page

An external or embedded payment form on a website or mobile app. Translated into 19 languages for the convenience of buyers from around the world, it automatically displays available payment methods to the payer, loads and displays correctly on all devices and browsers, and remembers customer data for one-click payments. With it, your sales will soar using our best payment gateway technology.

Flexible payment methods

You and your customers will have access to all modern payment methods, including bank cards from Visa & Mastercard, electronic wallets like Apple Pay & Google Pay, BLIK, and others. All of this ensures that you won’t lose a single customer when using our credit card payment gateway.

Accept payments from around the world

With us, you can sell not only locally in Czech Republic but also globally to the entire world. Service Fondy processes payments in 150+ currencies and allows you to accept payments from customers in 200+ countries worldwide. With our multi currency payment gateway, grow your business without borders – with or without a website.

Start accepting payments today

It’s so straightforward that you can sign up in the morning and accept payments from customers anywhere that same afternoon.

- Compatible with 15+ CMS platforms

- Simple API integration

- Supports 300+ payment methods

- Websites, apps and social media payments

- 23+ ready-made plugins

Customer stories

System Fondy has been a great partner for us when it comes to expanding our acquiring capabilities in Eastern Europe, leveling up the region’s acquiring capabilities. Their experience in the market has been invaluable, helping us scale across the region.

Florian Jensen

Global Fintech & Risk Director, Glovo

We have started using Fondy for our eCommerce vaporisation and CBD stores, and we highly recommend this to other eCommerce businesses.

Joshua Hegarty

Owner, GenuineCCELL

Everything in our store – from the brands to the products are of the utmost quality. We strive for perfection from start to checkout. Fondy support us to maintain our high standards.

Evgenij Prichko

COO, Helen Marlen Group

Maximize your opportunities

Single acquiring partner

One contract with provider Fondy combines working with few acquiring banks in Czech Republic and 30+ payment aggregators in Europe. Our unified approach simplifies your operations and expands your reach with our comprehensive payment gateway solutions.

Payment conversion up to 98%

Cascade routing, processing redundancy, and 99.95% uptime ensure the highest possible conversion rates. Our secure payment gateway technology maximizes your payment conversion, making your business more profitable.

Professional support

We are ready to assist you around the clock via phone and email, in messengers, and through the online chat on the website during connection and servicing stages. Our dedicated support team ensures that your payment operations run smoothly at all times.

Accept payments anywhere, any way

Start accepting payments quickly and easily

Integrate Fondy’s powerful payment gateway with your favourite CMS or CRM platform. With over 30 popular plugins, including seamless integration with Shopify, WIX, and WooCommerce, you can start accepting payments in no time. Our simple, step-by-step instructions ensure a smooth setup process. Plus, adding a ClickToPay button is just as quick and easy.

Get started today

Fondy makes it easy for customers to pay and simple for you to sell with all the flexibility and control you need

Open an account

Create a no-obligation account now and see how it works. You could even start trading today. Experience the benefits of our best online payment gateway firsthand.

Request a demo

Request a demo of our payment gateway portal today. Discover how our solutions can enhance your business operations and streamline payment processes.

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.