Use cases

Payments features

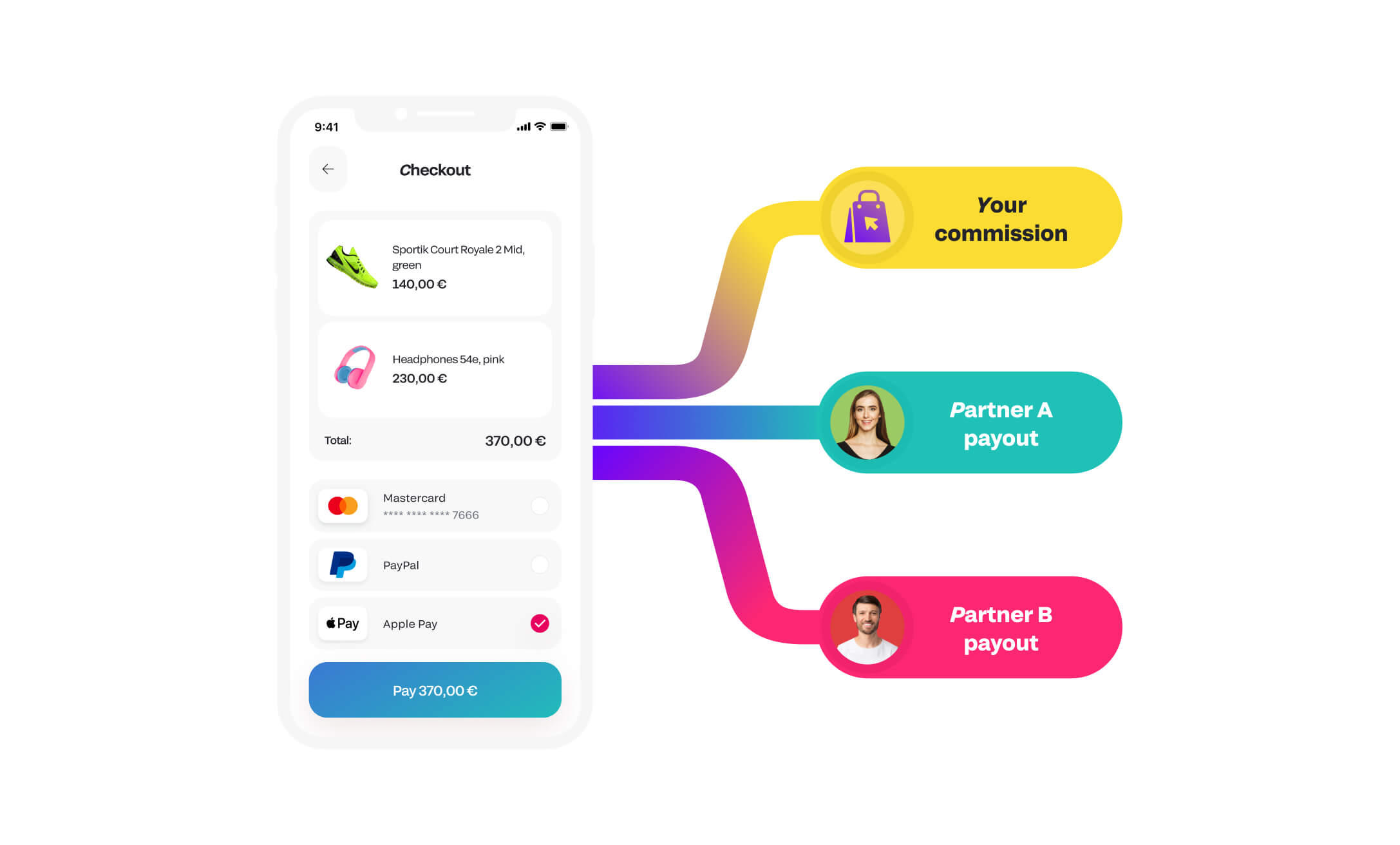

Split Payments

Split payments for your Maltese business

Unlock the potential of marketplace and platform-based business models, selling in Malta and worldwide with split payments. Effortlessly distribute revenue, commissions, fees, and more among partners.

Boost your business with automated Split Payments

With split payments online, the payment amount is automatically divided and credited to the accounts of multiple recipients simultaneously. This efficient tool is particularly popular among businesses that involve intermediary platforms or multiple partners. Examples include marketplaces, taxi services, ticket sales platforms, and travel agencies, where transactions often need to be distributed to various stakeholders quickly and accurately.

If you need to settle with multiple partners after each client payment, Fondy’s gateway automatic split payment method is the ideal solution. By using this service, you can save significant amounts of time by eliminating the need for manual settlements. Additionally, it helps reduce acquiring costs, as well as lowers the tax burden on your business. This automated approach ensures that your financial operations are streamlined, allowing you to focus more on growing your business and less on managing complex payment processes.

Leverage Fondy’s split payment system to enhance your operational efficiency, minimise errors, and improve overall financial management.

Transform your business and enjoy multiple benefits

Split versatility

Split Payments is ideal for online platforms listing products and services from various merchants and businesses with commission or fee-based models.

Split your way

Allocate each payment received by setting a fixed amount, a specific percentage, or a blend of both, and decide if the split happens directly from your Split Account or directly from the partner’s Wallet.

Split and split, again and again

Automate your payment splitting for recurring transactions, like service provider subscriptions, with our custom integration options.

How Split Payments work

1. Customer makes a payment

When a customer completes a purchase on your platform, gateway Fondy processes the payment seamlessly.

2. Payment allocation

The received payment is automatically split according to the rules you’ve set. Whether it’s a fixed amount, a percentage, or a combination of both, the split happens precisely as you define.

3. Funds distribution

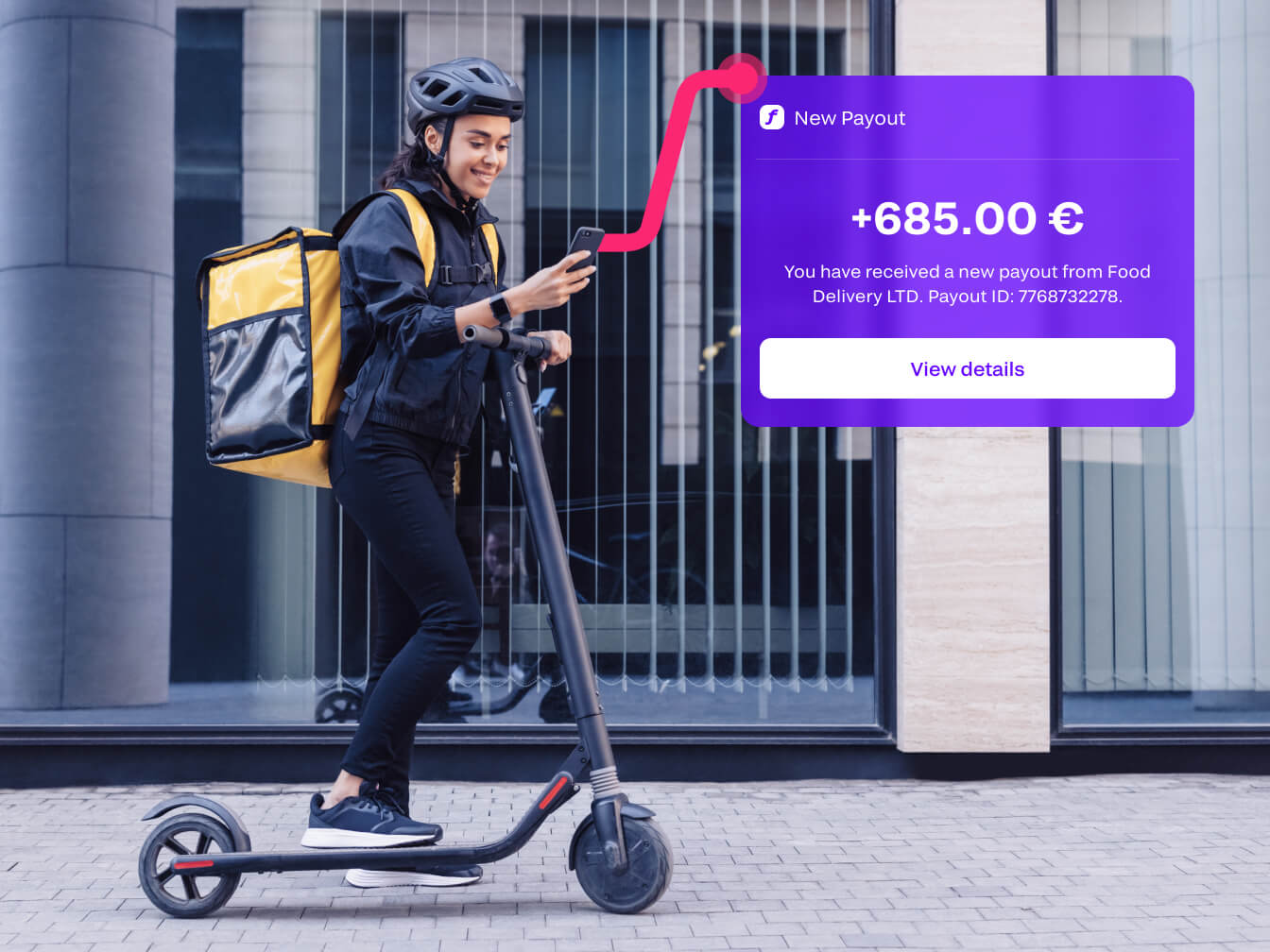

The allocated amounts are then distributed to the designated accounts, such as your partners’ Wallets or your Split Account, ensuring everyone gets paid accurately and on time.

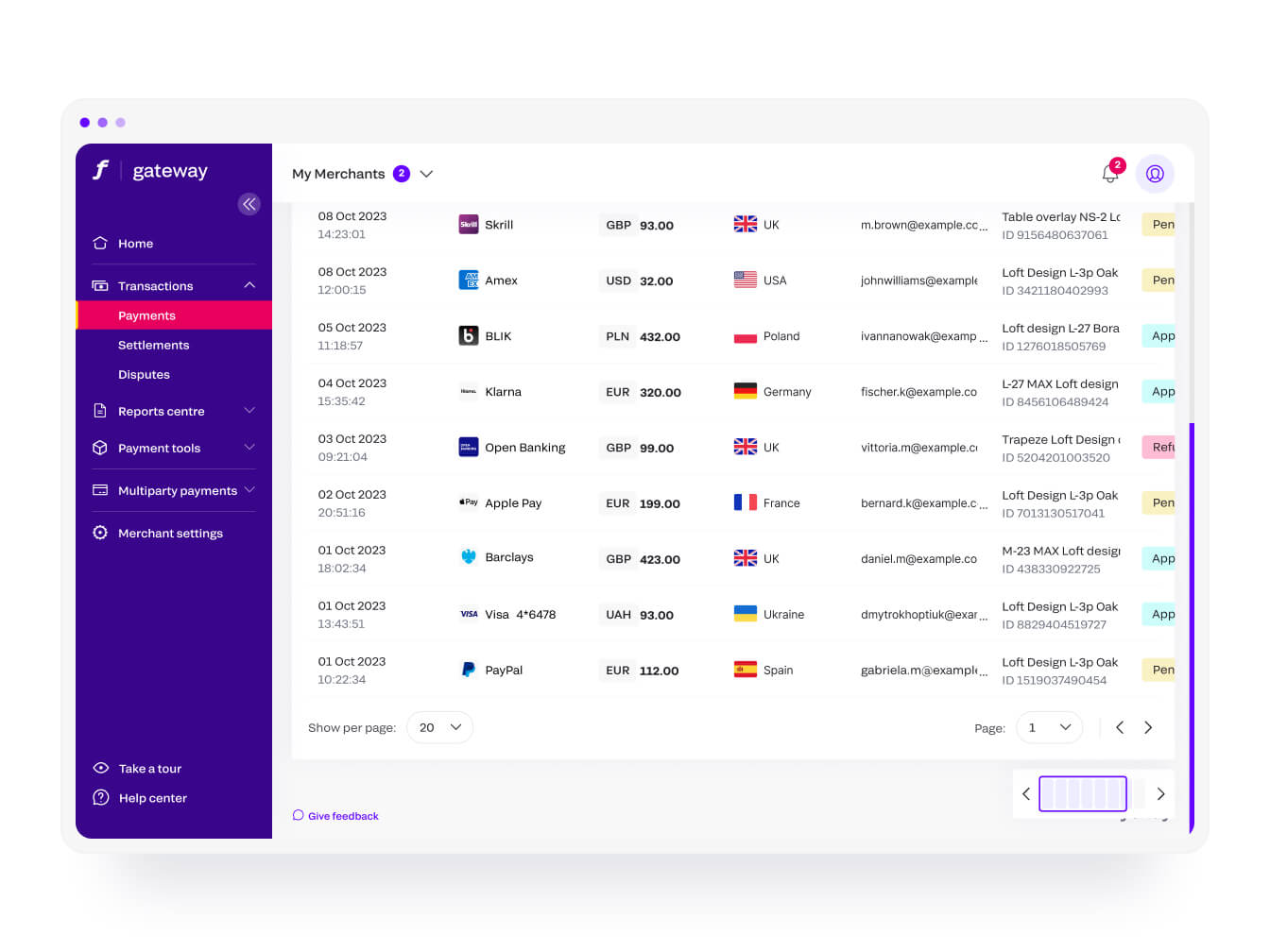

— Real-time tracking

Track all transactions in real-time through your Fondy dashboard. Gain insights into payment statuses, allocation details, and overall financial performance.

— Automate recurring payments

For businesses with subscription models or recurring transactions, Fondy’s Split Payments feature can automate the process, saving you time and reducing manual effort.

— Secure and compliant

All transactions are handled securely and comply with industry standards, ensuring your business operations remain safe and reliable.

Experience the ease and efficiency of Split Payments with gateway Fondy and streamline your financial operations like never before.

Maximise efficiency and growth with Fondy’s Split Payments

Save time and resources

Automate the splitting of payments between your various partners, including online sellers, content creators, tradesmen, drivers, and customers. Save essential time and resources, allowing you to focus on growing your Maltese business.

Boost conversion rates

Enhance your conversion rates by reducing cart abandonments and failed payments. Split payment facilities ensure a smoother checkout process, resulting in higher customer satisfaction and increased sales.

Enjoy full financial flexibility

Empower yourself and your partners with complete financial flexibility. With Fondy’s customisable commission models and fee structures, you can tailor the payment process to suit your business needs perfectly.

Benefit from enhanced security features

Protect your transactions with top-tier security measures and fraud prevention tools. Ensure a safe and reliable split payment and payout experience, giving you and your partners peace of mind.

Streamline to success

Reduce operational costs and improve user experiences by streamlining your processes with split payments. Optimise your business operations for both merchants and customers.

Utilise your business account

With split payment functionality, your partners can receive funds instantly without any charges or currency conversion fees. Experience seamless financial operations with Fondy.

The ideal fit for Splits

Split Payments (or Splits) are especially beneficial to modern business models in Malta. These models include some of the most well-known and popular brand names in use today, such as:

Optimizing eCommerce Marketplaces and Multi-Sided Platforms with Split Payments

eCommerce marketplaces

Marketplaces like Amazon, Etsy, and eBay sell a variety of products from a wide range of different sellers. Split Payments come into play when customers pay for multiple items (from different sellers) in one shopping cart and when different payment amounts need to be directed to different sellers.

Multi-sided platforms

Uber, TaskRabbit, and Airbnb, along with content and fundraising platforms or syndicate loan platforms, are prime examples of multi-sided platforms. These platforms connect gig workers like drivers, handymen, and homeowners, as well as content creators and fundraisers, with users and customers seeking services like taxi rides, home repairs, holiday rentals, digital content, or investment opportunities.

Payment analytics in the Merchant Portal

Use the Fondy personal account to monitor split payments with custom reports. View a list of all automatically or manually split payments, as well as information on the reasons for unsplit payments. You will have access to two reports:

- A list of all split payments, including information about recipients and the status of funds received.

- Unsplit payments – a list of all payments that were not split for various reasons, with detailed information on where the funds were sent, in what amount, and when.

Additionally, you can use custom reports from your marketplace or platform to track all split and unsplit payments, provided they offer this capability through the gateway Fondy API.

Get started!

Enjoy the benefits of Split Payments when you sign up for Fondy. Tap into versatile split payments, payout transactions, and settlements for your marketplace or platform with Fondy.

We use cookies to ensure our web-based products are functioning properly while continuing to improve your browsing experience, offering social media functionality, personalising our marketing and advertising content to suit your needs. We sometimes share cookie data with our partners for these purposes. Our cookies remember your preferences and the data you fill out on forms on our web products. As well as analysing traffic, our cookies register how you found us and collect information about your browsing habits. By continuing to use our web products, you agree to our use of cookies.